INTEGRIS for Financial Advisors

Give your clients the absolute best in wealth succession, business succession and tax optimization with a Personal Pension Plan

Join Us

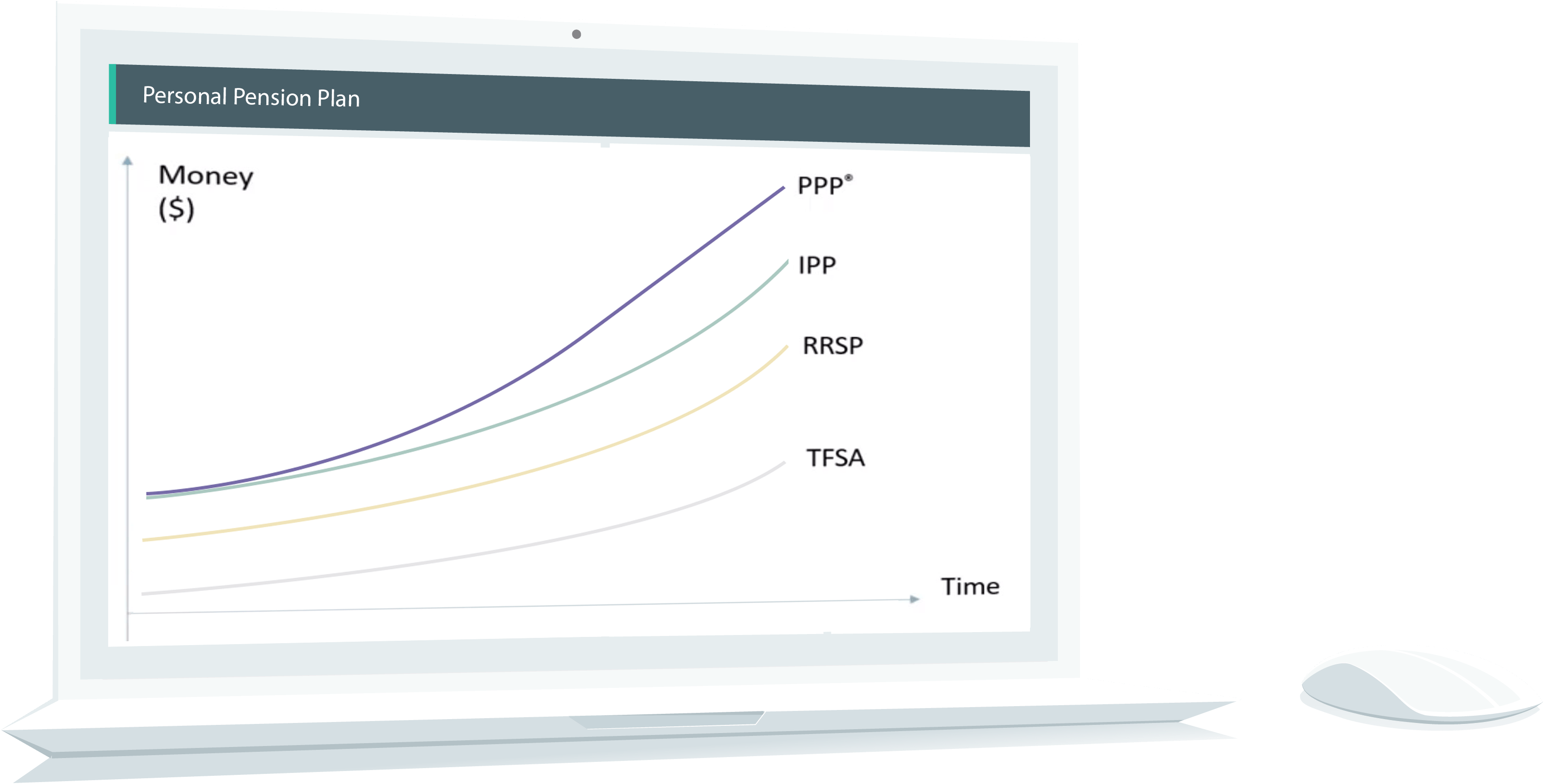

Offer your clients the Ultimate Tax Sheltering Vehicle

No one knows your clients like you do. We understand and respect this. At INTEGRIS we want to empower you to further this relationship by giving you another tool in your arsenal to help bring your clients closer to attaining their financial goals.

Have a client in mind?

Find out how much they can save

Sample INTEGRIS PPP® Quote

Sample INTEGRIS PPP® Quote

Investment Manager on File

Maintain the continuity of your investment advise by becoming the Investment Manager on file for your client's Personal Pension Plan.

Not interested in being the Investment Manager on file? You may appoint a qualified PPP® trained member of our INTEGRIS Financial Advisor Network.

Increase Assets Under Management

Since the INTEGRIS PPP® account accommodates all asset types, Clients may opt to move more of their non-RRSP assets into the Personal Pension Plan. This is often new assets Advisors previously didn't have access to.

The INTEGRIS PPP® allows clients to tax defer more capital by moving it to their Personal Pension Plan. This brings more assets under management for your firm.

Join UsAssistance in a rapidly changing world New

In a post-2020 world, advisors are forced to embrace a new world of work, collaboration, and relationship handling. In order for INTEGRIS to continue growing, we listened to the challenges of our advisors and sought out appropriate solutions.

Brand Building

Through podcasting, webinars, and articles, our partners elevate advisors and their businesses. Don’t have time to host a webinar? They'll create short-form content with you. That article you wrote last year? They'll help you fine-tune it. Our partners will illuminate what sets you apart in today’s marketplace.

Community Platforms

INTEGRIS looks to partner with communities to extend the reach of our advisors in finding new clients. We're invested in the success of our advisors as this evidentially leads to more opportunities for INTEGRIS to help Canadians in saving for a better future. Our community partners currently reach 2.9 million Canadians!

Great support & powerful technology

We've created technologies to simplify the complexities of creating and maintaining a Pension Plan for your clients.

In our practice, we've stayed away from an IPP because it was too cumbersome and lacked flexibility but now with INTEGRIS' PPP®, everything is simplified, it addresses the concerns business owners had with IPPs and we see an increase in assets under management for our firm.

— Dallas De Carlo, Director of Wealth Management

Training & Support

Excited with everything about the INTEGRIS PPP® but you prefer to have a more academic understanding of Personal Pension planning before offering it to your clients?

The top advisors often do — that's why we created the INTEGRIS Advanced Knowledge Centre.

Gain the knowledge and confidence you need to maximize your client's goals as the Investment Manager on File.

In light of the new tax rules that penalize passive investments within CCPCs, advisors must understand how pension legislation can become a powerful tool to deal with wealth succession, business succession and tax optimization within a corporate environment.

Learn More15 Reasons why you should consider a PPP® for your client

- Over 20 years, the PPP® member could have over $1,000,000 more in registered assets to retire on (assuming the same rate of return on assets as earned in an RRSP).

-

There are 7 new types of tax deductions inside a PPP®

that you cannot find inside an RRSP:

- Greater annual deductions ranging from $1,896 at age 40 to $18,481 by age 64 and beyond

- Terminal funding to enhance the basic pension (up to $2,000,000 deduction)

- Corporation’s ability to make tax-deductible contributions to assist in the purchase of past service

- Special Payments (also tax-deductible) if the pension plan’s assets don’t return 7.5%

- Interests paid to lenders for contributions made to the PPP® are tax-deductible

- Investment management fees paid on any asset inside the PPP® are tax-deductible

- Annual administration and actuarial fees are tax-deductible

- Assets inside a PPP® are trade-creditor protected.

- Required contributions to the PPP® owed by the corporation are provided super priority in a bankruptcy and rank above secured creditors like the banks.

- Assets inside a PPP® can pass from generation to generation without triggering a deemed disposition. Also, because the funds do not end up in the estate, there are no probate fees if other family members are also members of the PPP®.

- Ability to increase tax deductible contributions past the age of 71 via special payments.

- Corporate sponsor can claim back 100% of GST or HST levied against PPP®fees from the CRA via input tax credits.

- IPPs (Individual Pension Plans) must cease all tax deductible contributions if they are in excess surplus (in excess of 25% of liabilities). However, accruals can continue which will use up the surplus, and contributions to an RRSP can be made which can then be transferred to the PPP’s AVC Account.

- Additional tax savings opportunity upon set-up: members aged 38 and under who paid $100,000, for example, in the year of plan set-up could make an $18,000 PPP® contribution and an $18,000 RRSP, assuming no earned income in the year 1990.

- Unlocking: not only are AVC assets unlocked at all times (by eliminating the AVC provisions from the plan text), but by reducing accrued benefits and creating surplus, additional funds can be withdrawn.

- Participating life insurance add-on: the large tax savings/refunds created by the multitude of additional tax deductions could be used by the corporation to purchase an limited-pay overfunded Participating life insurance policy with the corporation designated as the death beneficiary, thereby funding the policy with $0.00 cost.

- Early retirement: available as early as age 50, with pension income-splitting and $4,000 worth of pension being eligible for the pension amount non-refundable credit. RRIF (Registered Retirement Income Fund) income-splitting only starts at age 65.

- Flexibility: being able to switch between a DB (Defined Benefit) and a DC (Defined Contribution) plan every year helps control pension costs. But the superior tax deductions afforded by DB plans aren’t lost in a DC year since the plan can be amended to convert DC into DB years (and allow for a past service contribution). Click here for a full breakdown of the advantages of the PPP® vs IPP

- Fiduciary and Governance: INTEGRIS offers a ‘pension committee’ service to ensure compliance and supervision with pension officers, compliance staff and lawyers at no extra cost.

- Purification for life time capital gains exemption: deductions created inside the company when purchasing past service, borrowing or doing terminal funding/special payments, can purify a corporation for this special tax exemption ($883,384 in 2020).

Our Process

For setting up a new PPP®

- Advisor completes the ‘Illustration Request Form’

- Advisor reviews illustration with an INTEGRIS Onboarding Specialist

- Advisor reviews illustration with the client

- Client makes payment to show commitment

- Complete the INTEGRIS PPP® ‘Set Up Form’

- Submit supporting documents (T4s, articles of incorporation, IDs, NOAs etc.)

- Client signs the legal documentation prepared by INTEGRIS

- Funding begins once plan is registered (approx. 10-12 weeks)

For upgrading an IPP to PPP®

- Gather all PPP® info

- Sign plan amendment

- Send to CRA

- Use the existing IPP account as the PPP® DB account

- Open PPP® DC account

- Open PPP® AVC account

- Continue funding