Every so often, INTEGRIS takes time to shine the spotlight on companies and partners that provide specific insights or have unique solutions that may be of application to our clientele or the broader financial community.

This week we are pleased to focus on alternative ways to manage equity risk in a turbulent market. The piece comes from Investment Partners Fund Inc. based in our Nation’s Capital.

By many measures, equity markets are presently quite extended to the upside. As was illustrated a year ago with the onset of the pandemic, declines from such extended conditions can be swift and vertiginous. Consequently, equity investors' thoughts might turn to ways to manage portfolio risks whilst continuing to participate in the market. Regrettably, many risk mitigation strategies are less than compelling under present circumstances, leaving investors challenged to find conservative approaches to addressing equity risk. The options-based approach of the Investment Partners Fund has weathered recent downdrafts with an active, limited risk derivatives strategy to manage the systematic exposures of its portfolio of listed equities.

While market timing is ill-advised, there is no question that modulating one’s risk appetite to prevailing conditions is prudent. When the weather threatens to turn cold on a planned outing, you needn’t cancel your plans, but packing a hat, mitts and an extra sweater is typically a good idea. Equity market conditions presently demand that sort of extra prudence. Valuations, particularly in the U.S., are now at extremes that presage weaker long-term returns. Meanwhile, financial conditions have been extraordinarily accommodative and investor sentiment has been euphoric. With the S&P 500 about 16% above where it was in February 2020 (pre-Covid), the market has already discounted a return to a vibrant economy with robust corporate profits, even with unemployment levels extremely elevated and untold damage to many businesses. While the market has clearly taken heart from the abundant monetary and fiscal stimulus and evidence that vaccination programs are soon to make great strides, the market’s ascent suggests much of this good news might now be in the price. Is there much more appreciation that can reasonably be expected? To use another metaphor, unless you plan to pull off the expressway, we suggest that prudence would dictate that, at a minimum, you should snug up your seatbelt.

There are currently few attractive risk management solutions for today’s environment of elevated equity risk. Indeed, investors face a menu of imperfect options. To begin, the balanced portfolio, which for decades has done yeoman’s work to diversify investor exposures, faces an existential crisis in light of high fixed income valuations. Whereas a bond allocation has heretofore offered investors a form of positive-yielding equity put option, whereby they earned a decent current coupon and then enjoyed capital gains as well when fixed income rallied during equity declines, those appealing characteristics have faded as fixed income yields have melted and the scope for price appreciation has withered along with it. The arithmetic of bonds is unforgiving and when bond prices are elevated and current yields low, its diversifying benefits are dramatically reduced.

Other equity risk mitigation strategies are also challenged. Long/short equity is an appealing approach, that of moderating market exposure by selling weak, over-valued companies short. Regrettably, there are very few managers who have the talent and experience to do it well. Problematically, if not invested with one of these rare superstars, the results can be catastrophic, as the meteoric January ascent of Gamestop and other troubled companies so starkly illustrated. Investing in low volatility funds is another alternative and, while this can work well, we were reminded a year ago that assets can behave in odd ways during extreme moves. Low vol funds can often navigate stormy weather better than most, but they are still fully exposed equity instruments that are vulnerable when correlations converge to 1, as they so often do during crises. Ultimately, the scope for true risk reduction is limited when one is still long equity beta, regardless of its form.

At the Investment Partners Fund, we seek to reduce systematic risk – which is to say the risk of general market declines - using an approach that is quite different from those mentioned above. While the core of our longer-term efforts at creating wealth is reasonably conventional – building a portfolio of equities chosen for their promise of compelling long-term returns – our risk management approach is slightly more unique. To attenuate the vulnerability of our equity portfolio to extreme “left-tail” events, we manage a portfolio of limited risk index options. This actively managed portfolio exists to provide asymmetric and convex results when equity market ructions precipitate drops in the headline indices. By constantly monitoring our exposure to systematic risk, and by constantly assessing the condition of the market, we modulate and adjust the scope and intensity of our options hedges to optimize our protection subject to considerations of expense and our assessment of risk. While this protection is not without cost, this cost often seems trivial following a disruptive market event. Rare is the vehicle owner who, immediately following a collision, complains about the cost of their policy.

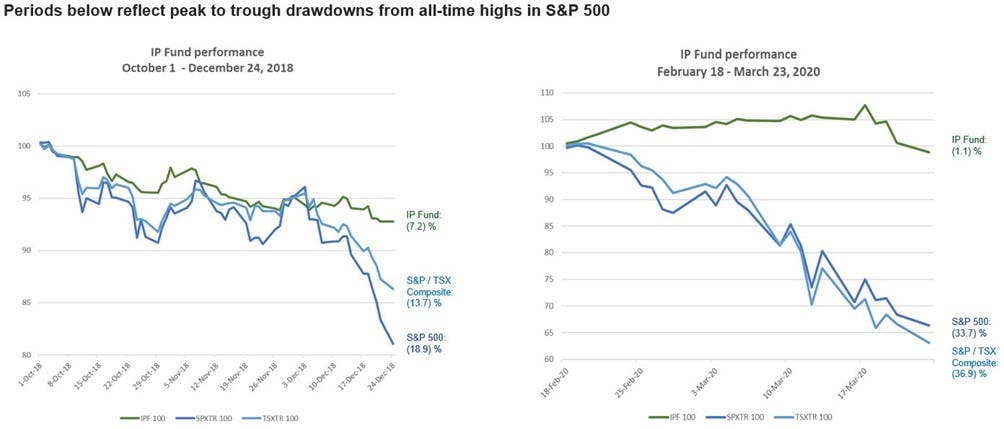

This approach has met with success during the two most significant recent declines, one in the fourth quarter on 2018 and the other, of course, in February and March of last year:

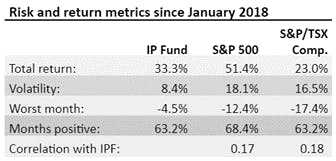

Overall, since January of 2018, our approach has been competitive with the S&P 500 and S&P/TSX Composite:

And what are the risks of this approach? Ultimately, the most obvious risk is that of a prolonged, low volatility bull market, which would cause the value of hedges to continuously erode and create a drag on overall returns. While such an outcome can be frustrating, it should best be thought of like the sunk cost of home or car insurance: we renew it annually and are, somewhat perversely, thankful when it expires unused. Another risk to our approach would be an environment where our systematic hedges against overall market risk prove ineffective against an array of idiosyncratic, stock-specific problems that impact our long holdings, a risk which is no different than that confronting any portfolio of equities.

At the IP Fund, we fully accept that we have no expertise in timing the equity market and we do not attempt to do that. Nonetheless, what we can do is examine the mosaic of factors that together create market conditions and modulate our risk exposures in accordance with those conditions. In so doing, we attempt to manage systematic risk and thus limit catastrophic drawdowns. We believe that an options-based risk management approach has many merits, especially in light of the limitations currently impacting other strategies.

Disclaimer

For Accredited Investors Only.

This article and its content are: (i) for information purposes only; (ii) not tailored to the needs or circumstances of any person; (iii) to the extent applicable to a particular security, only a general discussion of the security, and (iv) not to be used or construed as an offer to sell, a solicitation of an offer to buy, or an endorsement, recommendation, or sponsorship of any entity or security by Investment Partners Fund Inc. You acknowledge and agree that any request for information by you is unsolicited and shall neither constitute nor be construed as investment advice by Investment Partners Fund Inc. You should apply your own judgment in making any use of any content, including, without limitation, the use of any information contained therein as the basis for any conclusions. You bear responsibility for your own investment research and decisions. We make no representations regarding the suitability, profitability, or potential value of any particular investment or security referred to in this article.