“Given the personal angst felt by Canadians in these trying times, we remind you that there is a very safe solution available. Setting up a Personal Pension Plan is a smart move in these very turbulent times, for the following legal and economic reasons”:

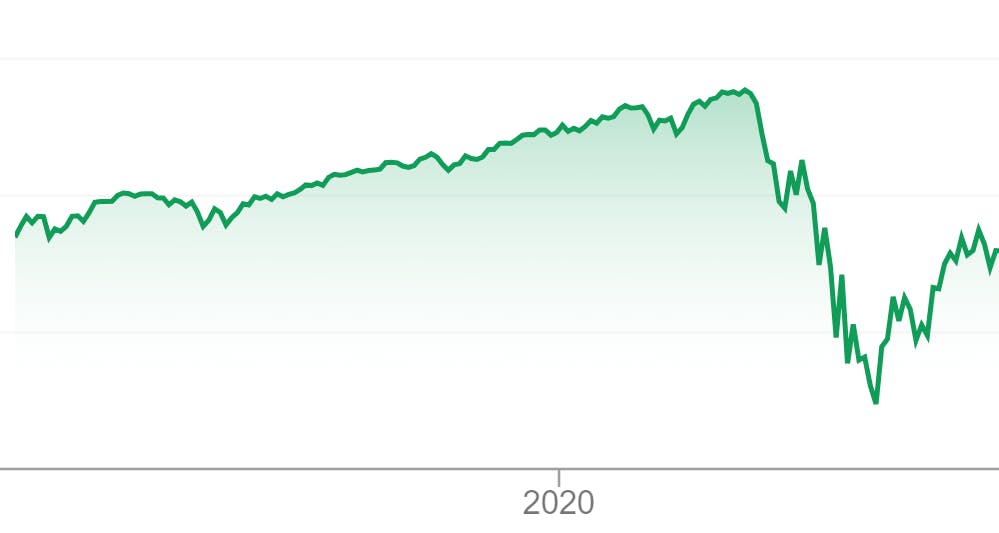

Thanks to ‘special payments’ companies can take pre-tax dollars and use them to go ‘bargain hunting’ for stocks whose value has been severely eroded by market panic. Individuals who have maxed out their RRSP contribution limits are not allowed to do this.

If clients are wary of investing in stock at all and decide to use ‘safer’ asset classes, these are well-suited to a pension plan because they will likely never earn the prescribed 7.5% rate of return, thus creating the opportunity for additional tax-deductible contributions in the future.

The added value of shifting passive investments out of an operating company or holding company (if it lends cash to Opco to contribute to the plan) is further protection from the Tax on Passive Investments brought about by the federal government in the 2018 Budget.

In addition, pension plans benefit from full creditor protection.

The required pension contributions for current/annual service are also granted super-priority in bankruptcy and rank above the claims of the secured creditors of the company that is sponsoring the pension plan.

The fiduciary oversight provided by our team acts as an ‘early warning’ system to clients. For example, we have recently helped a farm client set up a family pension plan that will save the children approximately $1.8M in taxes should the parents pass away in retirement. The previous financial advisor had looked at an IPP but dismissed it because they were not aware of the inter-generational wealth transfer feature of the plan and did not consider the children to be potential plan members.

Rolling existing RRSPs into the AVC component of the PPP takes non-deductible investment management fees and turns them into additional corporate tax deductions, thereby reducing the cost of investing and increasing the wealth of the client.